We offer finance solutions to complement our international payments and currency services, giving you a more complete way to manage your global operations.

For many businesses, growth is held back by short-term cash flow gaps, waiting on customer payments or needing to pay suppliers upfront. Our finance products help unlock working capital so you can act quickly, stay competitive, and reach your goals.

Solving Cash Flow Issues in the Travel Industry

A travel business faced cash flow struggles due to a 5-month gap between customer bookings and departure dates. With only a deposit paid upfront and thin margins, the business lacked the liquidity to reinvest and grow.

Solution: Invoice Finance for Faster Payments

Affinity’s Invoice Finance solution allowed the business to access funds tied up in future customer payments, enabling faster cash flow and reinvestment into growth.

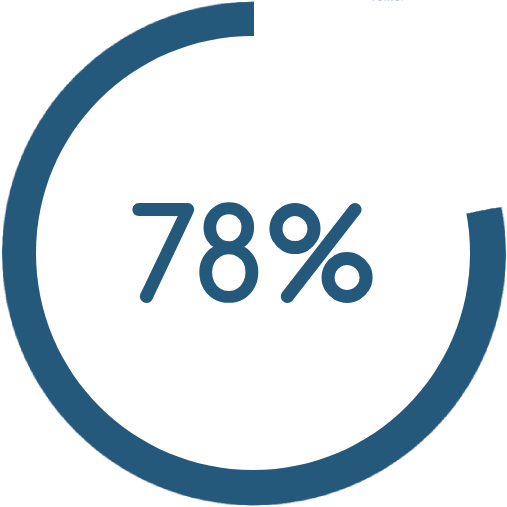

Result: Surpassing Revenue Targets and Growing

With improved liquidity, the business exceeded its targets by 15% and expanded its team.

Business: +44 (0) 20 3103 0301